Value Isn’t the Same as Sellability

A lot of business owners mix up value and sellability. They sound similar, but they’re not. Value is about money. Sellability is about transfer.

When a small business sells, the valuation usually comes down to one number: profit. Most deals are based on a multiple of Seller’s Discretionary Earnings or Adjusted EBITDA. If you want your business to be worth more, make more money. It really is that simple. But that’s only half the story, because buyers don’t just care how much money a business makes. They care how dependable that profit is once you’re gone.

What Buyers Actually Want

Sellability is about how easily someone else can step in and run things. It’s about risk. The less your business depends on you, the more sellable it becomes.

Buyers look for clear systems, a capable team, clean financials, and customers that aren’t all tied to one or two accounts. They want to know that if you left tomorrow, the company would still keep running without a meltdown. Profit attracts buyers, but sellability gives them confidence to move forward.

That’s something many owners underestimate. You can grow a profitable business and still struggle to sell it. If everything relies on your name, your relationships, or your personal touch, then what you’ve built isn’t a transferable asset, it’s a very demanding job. Buyers can see that from a mile away.

At the end of the day, a buyer isn’t just paying for your numbers. They’re paying for your absence.

The Four Types of Businesses

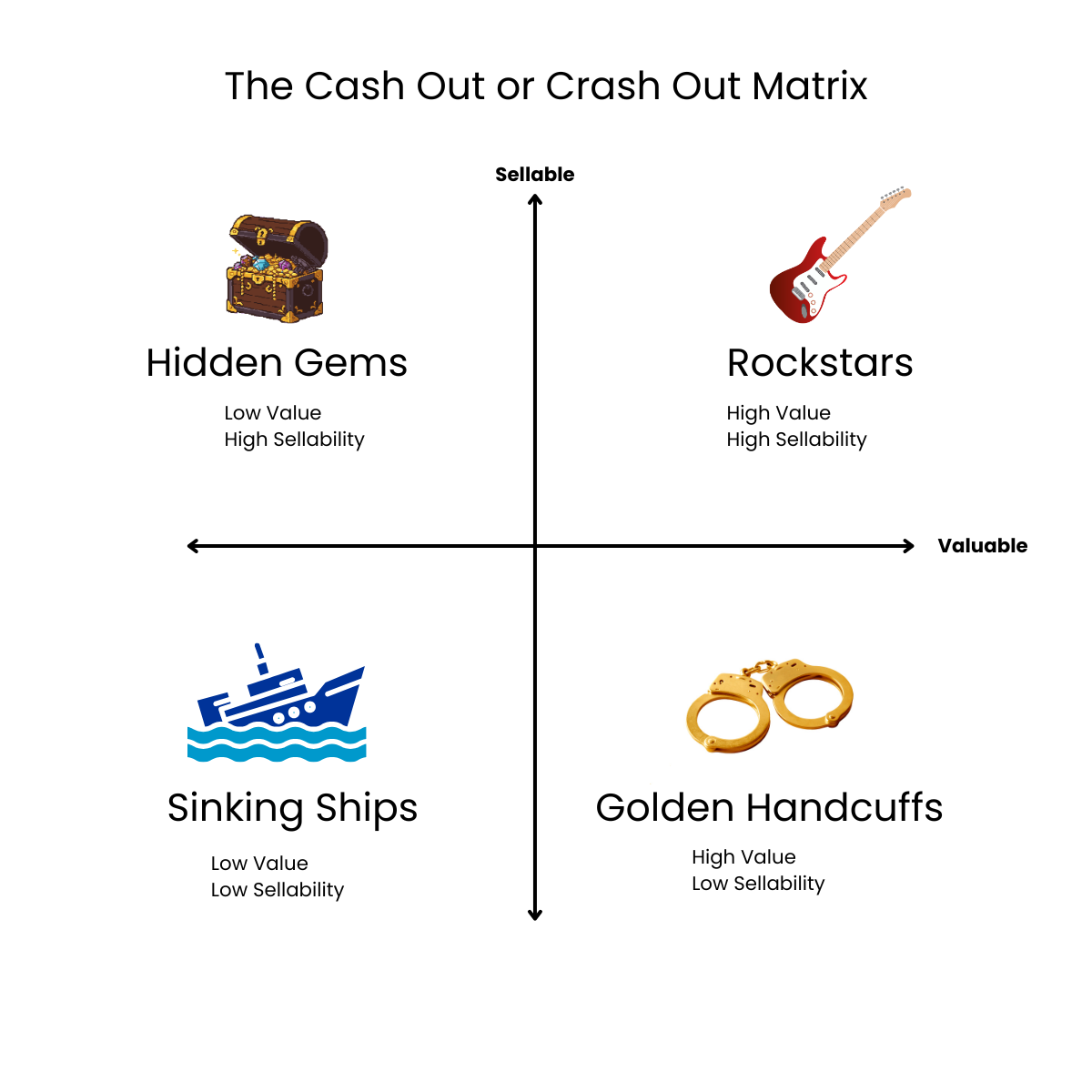

If you map value and sellability on a grid, you end up with four types of businesses.

At the top are the Rockstars. Profitable, organized, and independent. The owner could disappear for a month and it would still hum along. These are every buyer’s dream.

Then there are the Golden Handcuffs. High profit, but the owner is the business. Think tradespeople, consultants, or professionals who can’t really hand off what they do. They earn great money but have limited exit options. Buyers hesitate because they’re essentially being asked to buy your job.

The Hidden Gems are smaller businesses that might not have huge profits yet, but they’re well-run, low-risk, and easy to understand. A buyer can see the potential and imagine where to take it. With the right energy and capital, these can quickly move up to Rockstar status.

And finally, the Sinking Ships. Low profit, low sellability, often messy and hard to move at any price. Every broker has seen them—good intentions, bad records, and too many holes to patch.

Most owners assume they’re Rockstars because they make good money. But if the business stops when they stop, they’re not. They’re just handcuffed to their own success.

The Real Risk

Value feels tangible. You can see it on a financial statement and influence it by increasing sales or cutting costs. Sellability is quieter. It’s built over time through delegation, documentation, and leadership that creates trust. It’s what allows your business to keep moving when you’re not in the room.

I see a lot of owners who run great operations but haven’t built structure beneath them. Their name is on every contract. Their phone rings for every decision. Their team relies on them for direction. On paper, it’s a strong company. In reality, it’s one bad week away from chaos. That’s the difference between a business that works and a business that’s sellable.

A buyer wants to step into something stable, not inherit your burnout. When the entire operation depends on one person, the risk is too high, and that gets reflected in the price, or the lack of offers altogether.

Building Both

The goal isn’t to choose between value and sellability. It’s to build both at the same time. Profit gives you leverage. Sellability gives you options. A valuable business pays you well while you own it. A sellable business gives you freedom when you’re ready to leave.

If you’ve spent years focused on profitability, that’s a good start. But now it’s worth asking a different question: if you walked away tomorrow, what would happen? Would things keep running, or would they start to slide?

That answer says more about the true worth of your business than any spreadsheet ever could.